The flaw of averages (Or: why you’re not saving enough for retirement)

May 4th, 2007

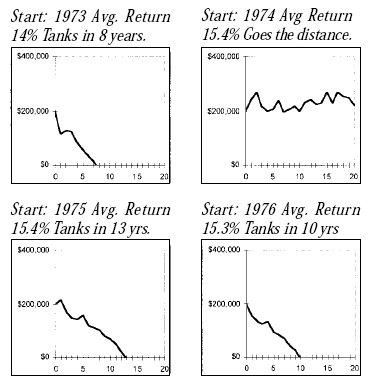

The stock market has an annual rate of return of 10%, so says popular belief. That’s great for pretty charts, but don’t bet your retirement on it.

The problem is that while the long-term average return might be 10%, the return in a particular period might be significantly different. Dr. Sam Savage wrote an excellent article on this topic. As he points out, retirement-year choice can be crucial.

[Figure: A fund can fail even with above-average returns (source)]

Unfortunately, the article is a bit light on practical responses. One possibility: save more, spend less.

(This post is part of the 100/100/100 challenge)

Recent Comments